IGI’s Parent Company Looking for Buyers

Fosun International, the majority owner of the International Gemological Institute (IGI), is mulling the sale of the Belgium-based diamond laboratory.

“After several fruitful years of growth and excellence alongside the diamond industry, the shareholders believe IGI is [ready] to enter a new growth phase and are currently reviewing candidate investors to further grow the company vision,” IGI CEO Roland Lorie said Friday in a statement to Rapaport News.

“IGI is and remains an independent expertise company managed directly by the CEO and the managers,” Lorie continued. “This possible change is, for the entire IGI team, a very exciting challenge.”

Bloomberg first reported the news that Shanghai, China-based Fosun was weighing the divestment of IGI, citing unnamed sources. The plans are preliminary, and Fosun may decide to keep IGI, the news service added.

Fosun is currently attempting to bolster its balance sheet and investor confidence, according to Bloomberg. In October, it told analysts it was aiming to sell as much as $11 billion of assets within 12 months, the report continued.

Backed by billionaire Guo Guangchang, Fosun acquired an 80% stake in IGI in 2018 for $108.8 million from shareholders Roland Lorie and Marc Brauner. The founding Lorie family kept the remaining 20%.

With more than 20 laboratories and 14 schools of gemology around the world, IGI claims to be the largest laboratory for the certification of diamonds and fine jewelry. It specializes in grading finished jewelry, natural diamonds, lab-grown diamonds, and gemstones.

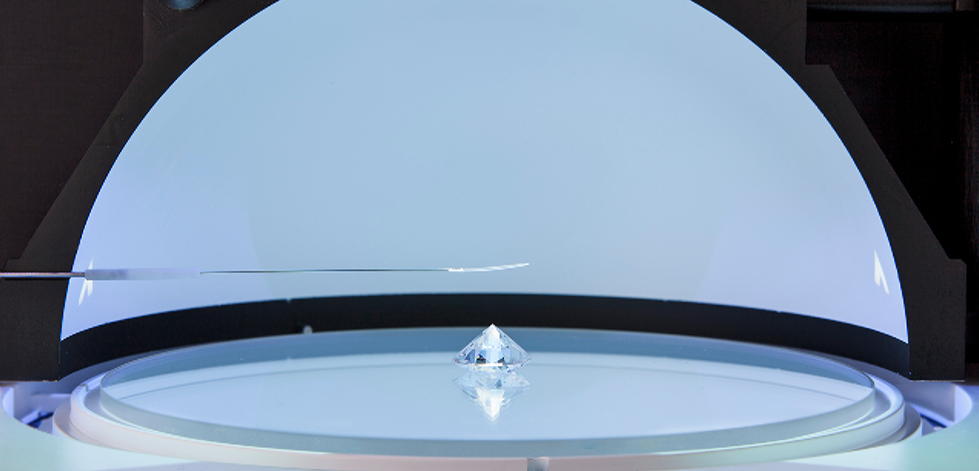

Image: IGI graders. (IGI)