De Beers Sales Fall Amid Slow Trading

De Beers’ sales declined in the second quarter as the diamond market slowed and buyers shifted to smaller, lower-value goods.

“Demand for rough diamonds was impacted by the ongoing macroeconomic headwinds, with high levels of polished-diamond inventory in the midstream,” parent company Anglo American said Thursday in a quarterly production report.

Sales volume dropped 19% year on year to 7.6 million carats for the three months. This also reflected the fact that De Beers held only two sights during the period, compared with three a year earlier.

Production fell 5% to 7.6 million carats, as output from the Venetia mine in South Africa slid while the deposit shifts from open-pit to underground mining. The company continues to process lower-grade surface stockpiles from the site during the transition.

Sales for the first half of 2023 were flat year on year at 17.3 million carats. The average selling price slipped 23% to $163 per carat as the product mix was more weighted toward lower-value rough, the company explained. “Sightholders took a more cautious approach to planning their 2023 allocation schedule due to the uncertain macroeconomic outlook,” management added.

Meanwhile, the company’s rough-price index, which tracks like-for-like pricing, decreased 2% year on year as an average for the six months. This mirrored “the overall softening in consumer demand for diamond jewelry and a buildup of inventory in the midstream,” the miner noted.

First-half production fell 2% to 16.5 million carats. The company maintained its output forecast of 30 million to 33 million carats for the full year, compared with actual production of 34.6 million carats in 2022.

RELATED READING

De Beers Merges Two Auctions Amid Slow Market

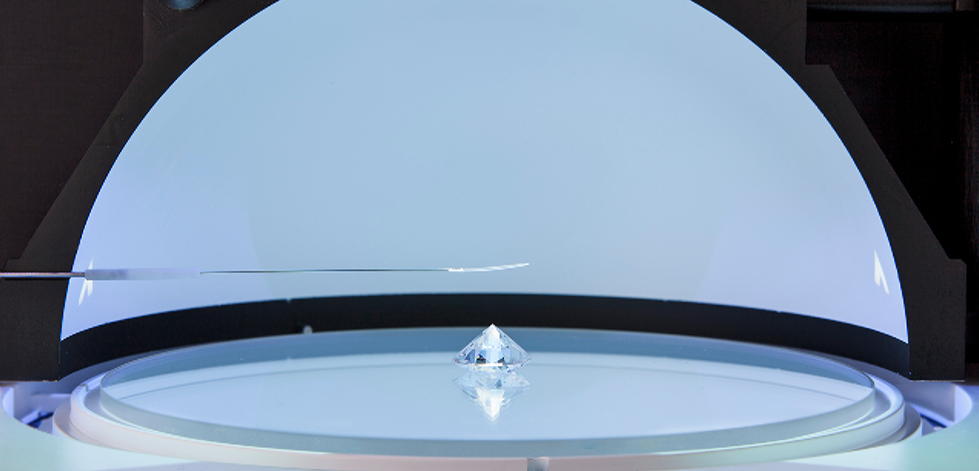

Main image: Rough-diamond sorting at DTC Botswana. (De Beers)