A Jewelry Safe Haven: US Market Shows Stability

The US jewelry market is showing signs of stability even as ongoing inflationary pressures and rising interest in synthetic diamonds weigh on sales. After several years of volatility, the market appears to have set a base from which to stimulate growth.

“Last year began a normalization after the declines experienced during Covid-19 and then the recovery,” observes Peter Smith, owner of The Retail Smiths, a consultancy for brands and retailers. “That is happening at a level we could have only dreamed of five or 10 years ago.”

Gross sales among independent jewelers slid 3% year on year in the first half of 2024, according to The Edge Retail Academy. While 2023 sales were down just slightly from the record set in the previous year, projections for 2024 reflect a return to pre-pandemic norms, the group has noted. Independents have outperformed the majors in recent years.

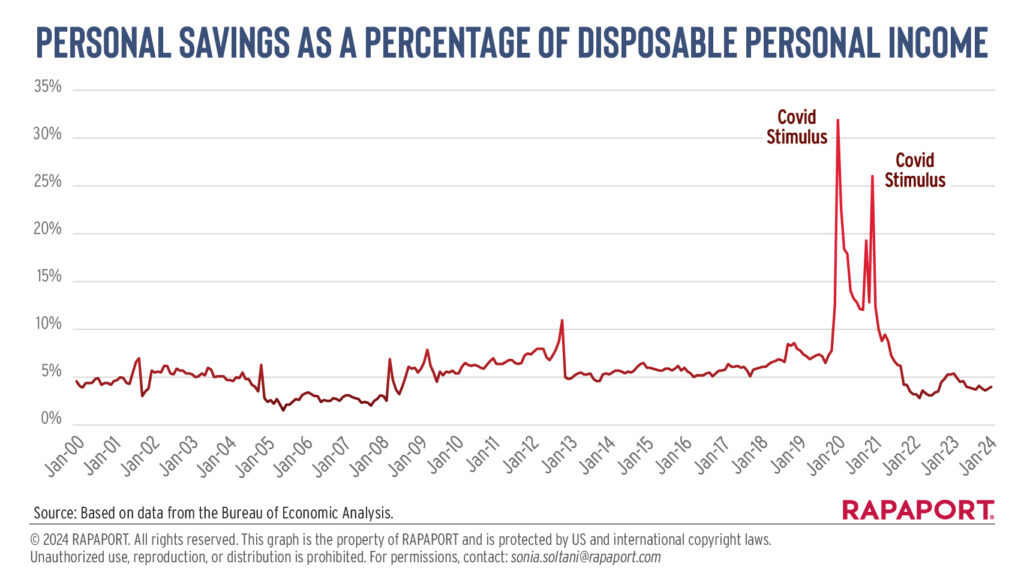

The industry enjoyed a growth spurt in 2021 and 2022, driven by pent-up demand and a spike in savings during the pandemic. Consumers turned to jewelry as they remained cautious about travel and other experience-based activities.

The market during that period provided a reminder that jewelers shouldn’t see other jewelers as their main competition, Smith stresses.

“When people couldn’t travel or go to concerts or eat out, they went to jewelry stores in shockingly large numbers,” he notes. “The big takeaway from that period is the relevance of providing really good jewelry experiences.”

Smith is encouraged to see more retail jewelers opening new stores and refitting existing ones. Those who are investing to enhance the in-store experience and are focused on execution are outperforming the market and enjoying a very good period, he observes.

Economic headwinds

That’s especially pertinent as the experience economy is back in full swing. US spending on international travel, which dipped from $181 billion in 2019 to around $40 billion during the pandemic, is expected to rise to $183 billion this year, according to the US Travel Association.

That doesn’t necessarily mean consumers are spending on travel instead of on other items. Rather, it signals a recovery of the middle-income consumer who will also lay out funds on jewelry, notes Harold Dupuy, vice president for strategic analysis at Stuller, a US-based jewelry wholesaler.

Still, there are economic headwinds to consider. Consumers are navigating higher interest rates and inflation that’s seen the cost of living increase about 17% in the last three years, Dupuy acknowledges. Personal savings, which drove the recovery from the pandemic, are now below the historic average.

Consumer sentiment as measured by the University of Michigan has gradually improved in the past two years, but is well below pre-pandemic levels, he adds.

Price pressure

Such a consumer landscape has enticed many jewelers to reduce their prices to stimulate sales, a strategy many advise against.

“There are those who try to be all things to all people, who say they are value driven but end up aligning with price,” Smith says. “This is where we’re seeing continued contraction.”

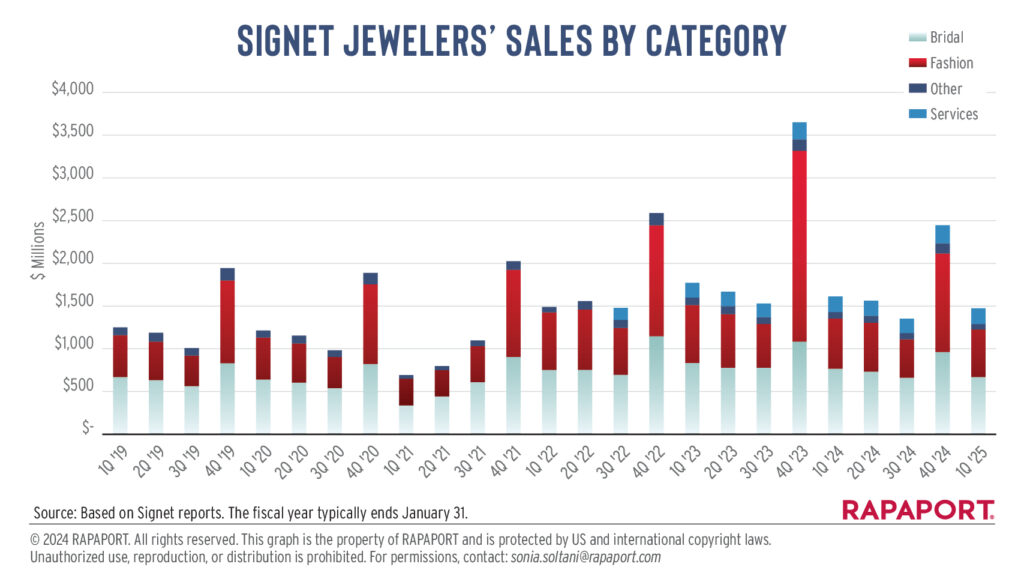

Signet Jewelers, the largest specialty jeweler in the US, emphasized that competitive price pressure due to heavy discounting by independents, particularly on higher ticket items, was a major reason its sales declined in fiscal 2024 and again in the first quarter that ended May 4. The company reported sales fell 9.4% to $1.5 billion in the three-month period, with same-store sales down 8.9%. Its average transaction value in North America declined 1.6% to $552, while the number of transactions fell 7.9%.

Lower prices also weighed on sales at Brilliant Earth, a sustainability-focused jewelry retail chain. Its average order value dropped 12% to $2,402 during the first quarter, offset by a 14% rise in total orders. Brilliant Earth’s net sales slid 0.4% to $97.3 million during the period.

Signet lags

While Signet is broadly seen as a bellwether for US jewelry retail, given it enjoys an estimated 9% market share, it has lagged the market by about 5% for the past seven or eight quarters, notes Dupuy. Smith suggests the company may be too reliant on malls where the recovery in visitor traffic has been slower than off-mall locations.

Industry insiders reason that sales and average price at Signet and many independents declined due to the adoption of synthetic diamonds.

“We could convince ourselves that instead of buying a three-quarter or 1-carat natural, retailers are selling a 2-carat or 3-carat lab-grown and getting the same dollars,” Smith argues. “But you’re deliberately conspiring to reduce your own average ticket.”

Impact on bridal

There is broad concern about the extent to which natural diamonds have lost ground to synthetics in the engagement and bridal segment. Signet’s bridal sales fell 12% to $639.3 million in the first quarter.

The company expects a spike in engagements in the next three years, reasoning that there has been a lag in proposals caused by Covid-19 when people were unable to date. Given the two- to three-year dating cycle, couples who met after the lockdowns are now due to take the next step, management argues.

Dupuy backs that theory with data showing the volume of Google searches for engagement rings has only recently started to recover. Others note that the number of weddings has returned to normal and suggest that Signet may be overselling its engagement-lag theory to investors without acknowledging the impact that synthetics have had on its business.

The narrative of Covid-19-related engagement counts, sluggish sales and the challenging macroeconomic environment deflects from Signet’s strategy to embrace synthetics, noted one diamantaire who requested anonymity.

The synthetics effect

Signet isn’t the only company that’s pushed synthetics in recent years. A study by Boston Consulting Group (BCG), which De Beers commissioned, noted that more than 70% of consumer conversion to synthetic over natural diamonds occurs in-store, with the higher profit margins driving retailers.

As retail prices of synthetics continue to fall and wholesale prices level off near the marginal costs of production, the incentive for retailers to promote natural diamonds is expected to increase, the report added.

Signet is shifting its attention back to natural diamonds and has partnered with De Beers to promote the “unique attributes” of the product among US couples. Part of the collaboration involves training Signet’s sales staff to talk about natural diamonds effectively.

Synthetics are slowing in the engagement segment at Stuller, which is a major supplier to independent jewelers, Dupuy observes.

“Retailers who were early adapters of lab-grown recognized when prices started to fall that they had to pivot with a stronger message back toward natural,” he explains. “They also had to maintain lab-grown because the consumer is at least a year and a half behind the supply side.”

For that reason, Dupuy suggests the transition back to natural will not happen overnight. Customers will come in and ask for synthetic diamonds, and that’s where jewelers will have to start promoting more on the natural side, he explains. “That’s a multiyear transition,” he predicts.

Brilliant execution

Meanwhile, as retailers marketed synthetics as a cheaper alternative to natural, Smith dismisses the notion that consumers are attracted to lower prices.

“Sales psychology shows that it’s not true that everyone wants to save money,” he explains. “Retailers providing the best experience expect more from their customers than price, and their customers are happy about that; they’re glad to have the experience. The idea of value has absolutely nothing to do with price.”

Backing that theory, Dupuy recognizes customization as a strong growth trend. With a similar drive for differentiation, many see branding as central to delivering that value and experience, particularly among younger consumers.

A Cartier jewelry store in New York. (Shutterstock)

The rise of brands is expected to continue fueling overall jewelry growth as there is an increasing emphasis on brand and design in jewelry selections, particularly in the US, BCG researchers wrote. The share of branded jewelry acquisition in 2021 was highest among younger generations: 76% for Gen Z and 72% for millennials versus 64% for Gen X and 38% for baby boomers, BCG found.

Smith notes that the concept of branding has changed, becoming more accessible for companies.

Whereas 20 years ago one would have looked at the legacy names such as Gucci as the benchmark, today the likes of Lululemon have shown that you can create a branded story to which young consumers will relate — and companies don’t need to spend small fortunes to do that, he explains.

Smith recognizes that the jewelry industry doesn’t capitalize on such cost-effective branding. However, jewelers shouldn’t let that trend distract them from the fundamentals in terms of product offering and the profile of the American customer, he adds, noting that the US market has always been about the bread-and-butter goods that sell in Middle America.

“This energy around differentiation misses the more important lesson of relevance,” Smith stresses. “The excitement of differentiation detracts from being relevant.”

Amid many distractions and challenges, both Smith and Dupuy expect continued incremental growth in jewelry sales for the remainder of the year. That will be stimulated by independents who are focused on providing the right product and value-driven experiences to their customers.

“The opportunity has always been to execute brilliantly in categories that are relevant to people,” Smith stresses. “It may not have happened for different reasons, but retail jewelry is a really great space for those who are executing well.”

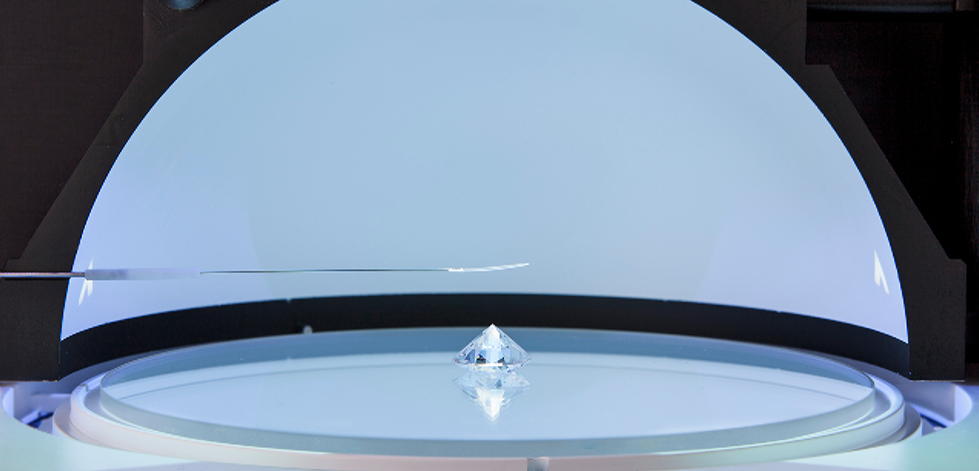

Main Image: David Polak/Midjourney