India Considers Its Future

The world�s largest manufacturing center faces some unfamiliar challenges amid apparent supply and labor shortages.

By Avi Krawitz

�We�ve seen it all before,� was the collective sigh that rang through Mumbai�s massive Bharat Diamond Bourse (BDB) when the pandemic initially broke out. �We got through other crises, and we�ll get through this one.�

The local diamond trade has a reputation for its distinct brand of optimism and cautious confidence, having thrived through the 2008 downturn and survived the many challenges in the decade since.

Some of those challenges have been uniquely Indian. There was the round-tripping debacle of 2012, which fueled a bubble in bank credit and diminished lenders� trust in the trade. And there was the government�s demonetization program in 2016 � often referred to as Prime Minister Narendra Modi�s attack on cash. While demonetization was deemed necessary to counter the rampant money laundering in the country, it sucked liquidity from the local diamond trade, putting businesses � predominantly small ones � under additional pressure in an already difficult market.

When it comes to global crises, India�s diamond community has been able to work in a more unified way.

It accounts for an estimated 95% of global polished-diamond supply. That means that most rough production finds its way to the country, where diamond factories add value by cutting and polishing at scale. But it is also engaged in jewelry manufacturing and design and has a large domestic consumer market for diamond jewelry that ranks as the world�s third-largest, according to De Beers� Diamond Insight Report.

When the market crashed in 2008, the trade collectively froze rough imports, which enabled it to focus on reducing existing inventory and freeing up liquidity. That action had a major impact on the rest of the industry, but it mostly helped India strengthen its position even further.

Yet in 2020, when the global market shut down as Covid-19 began to spread in late March, India�s dealers, manufacturers and jewelers � like those across the globe � were left dumbfounded. It soon became clear this was unlike anything they had previously experienced. Uncertainty and fear that the economic impact of the pandemic would surpass all other crises set in.

This time, Indian manufacturers didn�t need to take such deliberate collective actions, though they claim to have done so anyway. The market made the decision for them: Mining companies stopped selling rough, and trading froze. Besides, no one could travel to buy goods.

Surprising turn

Either way, the rough-market shutdown propped up the manufacturing sector the same way it did in 2008 � arguably more so. It helped reduce excess polished inventory, which had weighed heavily on the trade for years before. Just 16 months after the initial collapse, with the benefit of hindsight, Indian diamantaires see the downturn as a blessing in disguise.

Whereas before the pandemic, an oversupply of diamonds had burdened the market, today there is a scarcity of goods, notes Anshul Mehta, a partner at certified-diamond supplier Subir Diamonds.

�Demand is much higher than supply,� he observes, adding that the recovery has been driven by the strength of the US and Chinese retail markets, where the large jewelry chains are competing for limited production.

Among India�s biggest challenges is securing supply to keep up with demand in both the short and long term. That�s a surprising turn of events, considering the excess supply that constrained the market in the past decade, and bearing in mind that demand stagnated during that time.

The Diwali deadline

While demand has bounced back, supply has been volatile. Sporadic outbreaks of the coronavirus impacted both rough production and polished manufacturing over the past year. Between April and June this year, factories reduced their output by 30% to 40% as the Delta variant caused a spike in infections in the subcontinent. Meanwhile, manufacturers had goods in the pipeline, having bought high volumes of rough and manufactured them in 2020�s fourth quarter and 2021�s first, when infection rates were down. A backlog of more than a month developed at the Gemological Institute of America�s (GIA) Mumbai and Surat labs.

Polished production is now back to normal levels, stresses BDB chairman Anoop Mehta, who is also CEO of manufacturer Mohit Diamonds. Rough buying has stayed strong despite the high prices. And while turnaround times at the GIA remain at about 40 days, polished exports are rising, as figures from the Gem & Jewellery Export Promotion Council (GJEPC) show (see graph below).

For many Indian businesses, the big test of the market�s resilience will come around the Diwali festival, which takes place this year on November 4. Businesses typically take two to three weeks off for the holiday, and that period of inactivity may help ease some of the stress on the GIA�s systems, since it will have a lower intake of goods.

For its part, the GIA has added staff in Mumbai and Surat and is working to reduce service times in all locations as much as possible, a spokesperson recently told Rapaport Magazine. �Global submissions of diamonds to GIA laboratories and our global output remain at record levels,� he added.

The market should also have clearer expectations for the US and Chinese holiday seasons by the time Diwali begins. Anshul Mehta projects that demand will outpace supply at least until then. Afterward, the only thing that could derail this dynamic would be poor holiday sales, he suggests. �If Christmas is good, then the supply shortage will continue.�

That doesn�t necessarily mean polished prices will continue to rise through the end of the year. Already, retailers are resisting the higher price levels that Indian manufacturers are trying to push following the rough-price hikes in recent months, according to a manufacturer who has requested anonymity.

Market consolidation

Despite the shortfall in supply, there is some �irrational exuberance� in terms of the price people are willing to pay for rough, continues the manufacturer, who is a De Beers sightholder. �There is a gulf between supply and demand, and polished has also been strong,� he says. �But lately there is growing concern that profit margins are tightening. At these rough-price levels, the business may not be viable in the short term.�

The industry has had a strong run of profitability over the past year since the downturn (see graph, Page 23), particularly larger manufacturers that had the liquidity to buy goods when the market was at its lowest point. They could also mobilize staff when social distancing and other workplace restrictions were enforced, notes Ankit Shah, a partner at manufacturer Ankit Gems, which has factories in Surat and Namibia.

The larger manufacturers gained some market share � or emerged from the pandemic stronger � even though smaller businesses eventually also benefited from the recovery. The large exporters were better equipped to operate in the new remote environment, Anshul Mehta says. With their larger inventory and liquidity, they could send stones out on memo, since no foreign buyers could come to India to view goods. That�s not something the smaller operators could afford.

Many large-scale manufacturers had also invested in developing their online platforms before Covid-19 struck. As such, they already had the systems in place to provide accurate information about their inventory, good images, and e-commerce options during lockdown, he adds.

Beneficiation burdens

Now, with supply lagging behind demand, the larger manufacturers have better access to rough because they buy directly from the mining companies. That again puts them at an advantage over smaller cutting and polishing operations, which source from auctions � where competition is strong � or on the secondary market, where premiums have sometimes been double-digit percentages.

However, larger manufacturers are also adapting to a changing dynamic. Access to rough is expected to become even more exclusive, and the market is becoming more streamlined. De Beers split its sightholders into three categories � manufacturers, dealers and retailers � for the contract period that began on April 1, and has reduced supply to dealers. It wants goods converted to the end product more efficiently, which leaves fewer goods trading on the secondary market, sightholders said at the time.

In addition, De Beers is shifting more of its larger goods to Botswana and Namibia to boost beneficiation � a program to broaden diamond activity in mining countries beyond mineral extraction. Considering that De Beers is the largest supplier of 2-carat and larger rough, southern Africa�s gain is India�s loss.

�Those goods used to come to India,� Anoop Mehta says. �And nobody can replace those, because there�s a shortage of production in mining.� Alrosa has had its own production challenges this year, and other miners don�t have the quantities to fill the hole that De Beers� shift to southern Africa has left in India, he suggests.

The Argyle effect

Meanwhile, Indian manufacturers are also considering the impact that the recent closure of the Argyle mine in Australia will have on the sector. Argyle, which averaged annual production of 12 million carats over the past decade, was largely responsible for India�s emergence as a major manufacturing force. Only Indian factories, with their low labor costs, could polish the low-value Argyle rough into gem-quality stones. With the mine shut and with less rough output overall in 2020, shortages remain an issue, says Anoop Mehta. �Polished is moving well, and the pipeline got cleared out, [but] it�s not being replaced.�

While some argue that lab-grown may fill that vacuum, executives who spoke with Rapaport Magazine see the two as separate products. �Lab-grown doesn�t solve the problem for the natural-diamond market, but it does help with labor,� says the anonymous manufacturer.

Many Indian manufacturers have ventured into polishing lab-grown stones, which have seen increased demand over the past two years. And many workers have shifted to those production lines, according to Shah.

That has created a dearth of skilled labor for natural diamonds, especially now that manufacturers are trying to raise production to fill the growing demand. �Production has gone up, but the skilled labor has not increased compared to the rise in capacity,� affirms Gourav Sethi, a founder of Naturalmark, which offers a screening service for natural and lab-grown diamonds.

Anoop Mehta is confident that India will have the capacity to polish whatever goods become available. Market forces will play out and ensure there is balance, he predicts, even with the current anomaly of rising demand, insufficient supply and a shortage of workers.

Perhaps it�s all part of the adjustment India has had to make over the past year of unexpected change, adds the anonymous sightholder. �The industry is in very good shape when you consider where we were a year ago.�

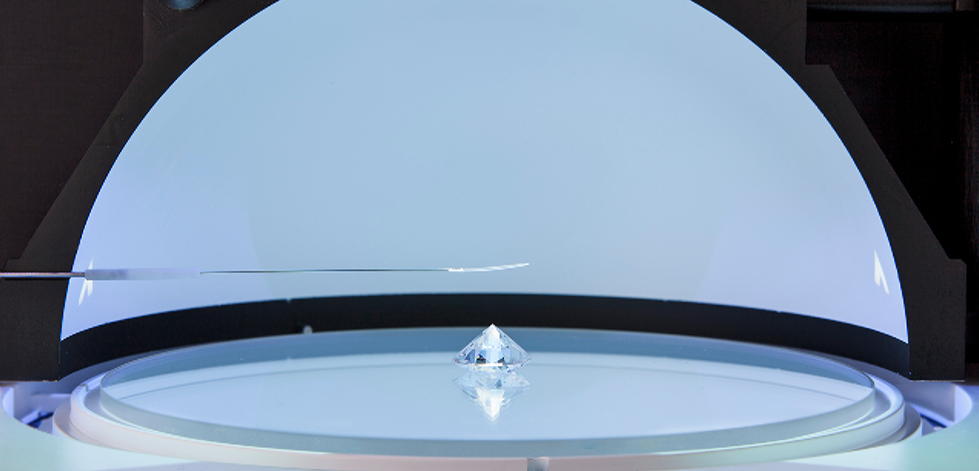

Image: Barry Downard/D�but Art.